Despite some BTC positions being underwater, data shows long-term holders continue to accumulate bitcoin in the current range.

Data on the chain shows that long-term Bitcoin holders continue to “absorb supply” at around $30.

Bear markets are usually marked by capitulation events, where discouraged investors eventually abandon their positions and asset prices either consolidate as less money flows into the sector, or begin the bottoming process.

According to a recent Glassnode report, Bitcoin holders are now “the only ones left” who seem to “double down as the price corrects to below $30,000.”

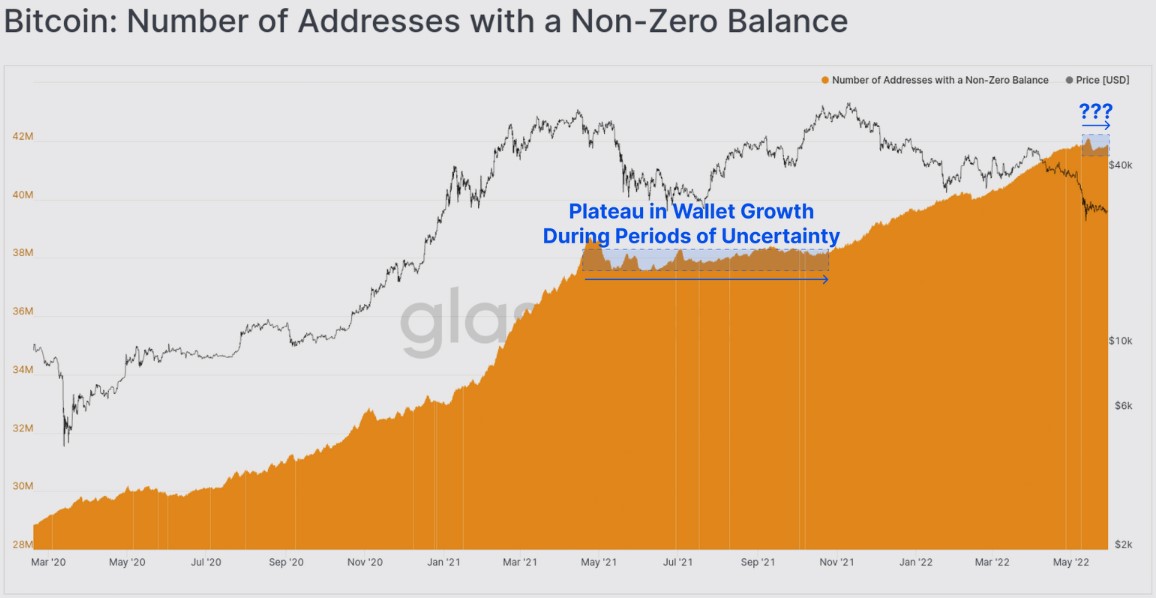

A look at the number of wallets with non-zero balances shows evidence of a lack of new buyers, a number that has leveled off in the past month, a process that occurred after the May 2021 cryptocurrency market sell-off.

Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an uptick in on-chain activity that “kick-started the subsequent bull run,” the recent sell-off has yet to “inspire an influx of new users into the space,” Glassnode analysts say, suggesting that current activity is largely driven by dodgers.

Signs of massive accumulation

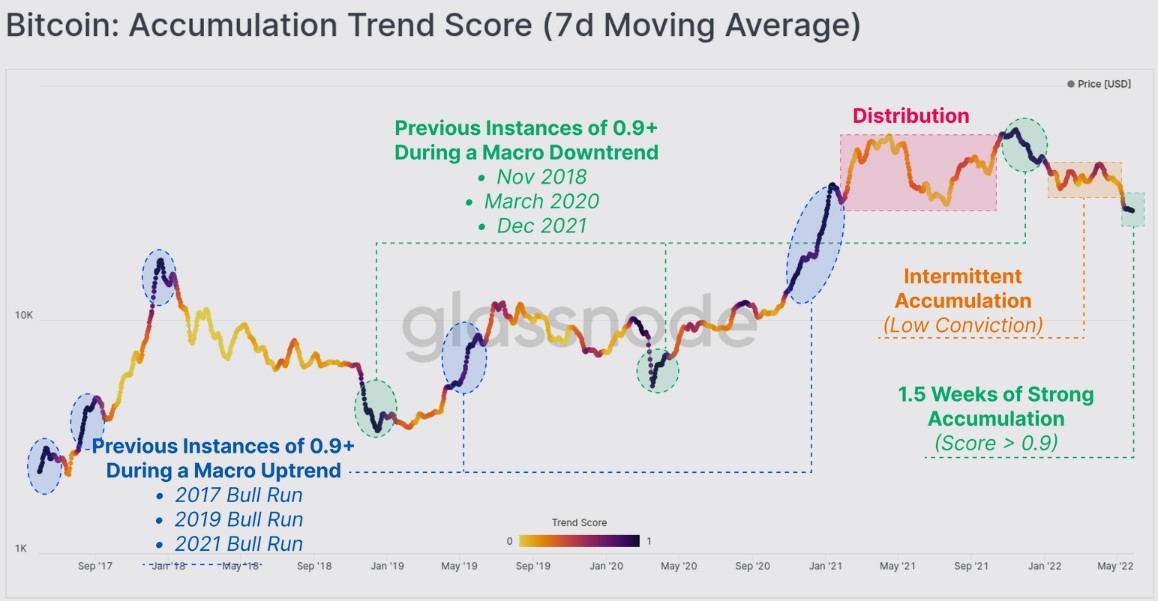

While many investors are not interested in the sideways price action in BTC, contrarian investors see it as an opportunity to accumulate, as evidenced by the Bitcoin Accumulation Trend Score, which has “returned to a near-perfect score of 0.9+” over the past two weeks.

According to Glassnode, a high score for this indicator in a bear market trend “is typically triggered after a very significant price correction, as investor psychology shifts from uncertainty to value accumulation.”

CryptoQuant CEO Ki Young Ju also noted the idea that Bitcoin is currently in an accumulation phase, posting the following tweet asking his Twitter followers “Why not buy?”

A closer look at the data reveals that the recent accumulation has been driven primarily by entities with less than 100 BTC and entities with more than 10,000 BTC.

During the recent volatility, the total balance of entities holding less than 100 BTC increased by 80,724 BTC, which Glassnode notes is “strikingly similar to the net 80,081 BTC liquidated by the LUNA Foundation Guard.”

Entities holding more than 10,000 BTC increased their balances by 46,269 bitcoins over the same period, while entities holding between 100 BTC and 10,000 BTC “maintained a neutral rating of around 0.5, indicating that their holdings have changed relatively little.”

Long-Term Holders Remain Active

Long-term bitcoin holders appear to be the main driver of the current price action, with some actively accumulating and others realizing an average -27% loss.

The total supply of these wallet holdings recently returned to an all-time high of 13.048 million BTC, despite the selling witnessed by some in the ranks of long-term holders.

Glassnode said.

“Barring a major coin redistribution, we can expect this supply metric to begin climbing over the next 3-4 months, suggesting that HODLers continue to gradually absorb, and hold, supply.”

The recent volatility may have squeezed out some of the most dedicated bitcoin holders, but the data shows that most serious holders are unwilling to spend their supply “even though it is now held at a loss.”

Post time: May-31-2022